The Spring Statement: The Battle Between Cuts and Growth

Navigating Political Resistance and Fragile Economic Forecasts

As expected the Spring Statement focused on OBR forecasts and benefit cuts. Seeing these points actually delivered by the Chancellor didn't make the UK’s economic outlook seem any brighter. The challenges that lie ahead are still significant and it seems likely that more spending cuts or possibly tax increases

I thought it was worth drawing out five key takeaways, exploring the political challenges, growth strategies, and economic implications for households and the broader landscape.

1.Rachel Reeves is up for the fight but it will be politically difficult

Responding to announcements which seek to reduce benefit spending and reduce the size of government are going to be difficult for the Conservatives to oppose given they would probably do the same. Their attack lines about this being an emergency budget fell flat and also gave the Chancellor the opportunity to remind everyone the last actual emergency budget was delivered by a Conservative Government following the disastrous”mini-budget.”

More worrying for the Chancellor and Prime Minister will have been the opposition from within their own party.

Rachael Maskell, Labour MP for York Central and rapidly become one of the main voices to government spending cuts, said fiscal responsibility was important to stop interest rates from going up, but this shouldn't be achieved “on the back of millions of people” on low incomes.

Other criticism came from Andy Macdonald, MP for Middlesbrough and Thornaby East who said that welfare cuts would reduce the incomes of his poorest constituents and tht instead taxes should be increased on wealthier people:

“That contrasts with the easy ride that the very wealthy get from low margins of tax on their assets and gains, than my constituents face from income tax. The world has changed since she set her fiscal rules, would she consider putting CGT on an equal footing with income tax.”

While they are not the force they once were within the Labour Party Alex Charilaou, co-chair of Momentum, the leftwing Labour will represent the views of a decent number of Labour MPs:

“Balancing the books on the most vulnerable in society was not in Labour’s manifesto, nor is it what voters voted for. But it’s clear from this Spring statement that the government is continuing down the path of Tory austerity. Labour MPs now must speak out and let it be clear that this is not what the labour movement stands for.”

There was not support from other more left leaning parties with Lib Dem leader Ed Davey, argued that:

“These cuts will be a double whammy to the most vulnerable, hitting disabled people who cannot work while slashing support for the loved ones who care for them.”

Criticism also came from groups working on living standards and with those impacted by the changes.Ruth Curtice, Chief Executive at the Resolution Foundation, argued that while the Chancellor was right to balance he books she was “wrong to do so on the backs of low-to-middle income families, on whom two-thirds of the welfare cuts will fall.”

Carers UK highlighted that the most recent set of benefit reforms will include the first substantial cuts to carer’s allowance in decades will see 150,000 carers losing the allowance as set out below.

The Chancellor and by extension the rest of the Government seem willing to take these critics on in the same way they’ve responded to political challenge over the end of winter fuel payments, inheritance tax changes affecting farmers and shifting the international aid budget to defence spending.

Whether the unity in the higher reaches of the Labour Party will hold together may now become a challenge and a lot of political capital has been expended to deliver all these changes.

2. Government is relying on planning reform and housebuilding for economic growth

A bright light for the Chancellor in the OBR figures was their assessment that planning reforms could lead to a 0.4% uplift in GDP over next ten years adding £15.1bn to the UK economy over that time

The OBR said that between 2025-26 and 2029-30 an extra 1.3 million homes would be constructed, 200,000 shy of the government’s 1.5 million target.

They estimated this would raise the UK’s growth potential by 0.4 per cent in a decade, owing to “a boost in the productivity of residential construction and the increased flow of housing services from the higher stock of houses”.

If this happens it would put the Government in “touching distance” of fulfilling the Labour manifesto pledge of building 1.5mn homes by the end of this Parliament

Government’s commitment to using housing as a way of driving economic growth and supporting communities was also demonstrated by the £2 billion brought forward ahead of the spending review for affordable housing. The additional funding for construction skills training also reinforces the importance of housing to the economic growth agenda

3. Household Hardship and Personal Economic Outlook

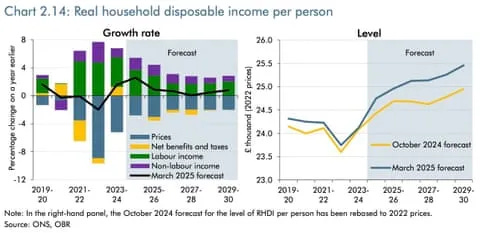

Real household disposable income, effectively how much money people have to spend after tax, essential spending and inflation, is forecast to increase by 1.7% this year This is significantly less than the 3.9% growth recorded in 2024.

It gets worse from then on with disposable income growth slowing to 1.1% in 2026 and then further to 0.5% in 2027and 0.7% in 2028, before a slightly higher increase of 1.2% in 2029.

It may also get even worse for households with ING predicting further tax rises in the Autumn Budget unless there are significant upwards revisions to GDP growth forecasts or a fall in gilt yields - neither of which are in their economic base case.

With cost of living increases still a challenge and people feeling less well off than they have done in the past and in comparison to previous generations this is a significant electoral challenge for the Labour Party.

Having been elected in part due to people feeling let down by a Conservative Government they will need to make people feel better off by the next election to stay in power and maintain the size of their majority. Young people in particular will want to see things getting better and a social media savvy Reform Party could start to take more votes among the younger age group

4. The practical steps to reduce the size of the civil service are being put in place

The prominence of a £3.25 billion Whitehall “transformation fund”, part of which will be used to pay off failing civil servants shows the level of commitment to reducing the size of government.

As well as facilitating job cuts the scheme is designed to help public services invest in modern technology such as artificial intelligence, would include “funding for voluntary exit schemes to reduce the size of the civil service”. This funding will be around £150m.

Government’s plan is to reduce departmental administration budgets by 15 per cent to save £2.2bn a year by 2030. This is vital to keep the Chancellor’s plans on track with only cuts to disability benefit leading to a bigger reduction in Government spend by 2030 as set out below:

5. Cash ISA reform in train for later this year

It was hidden away in the Spring Statement document but as expected the Chancellor confirmed there will be a review of the ISA system. The document says that:

“The government is looking at options for reforms to Individual Savings Accounts that get the balance right between cash and equities to earn better returns for savers, boost the culture of retail investment, and support the growth mission. Alongside this, the government is working closely with the Financial Conduct Authority to deliver a system of targeted support to give people the confidence to invest.”

On this the next few months are likely to be dominated by discussions on the importance of savings, consumer support for cash ISAs and the role they play with building societies vs the desire to increase investment, raising government income and the desire by investment management to secure more funds under their management.

It seems to me that some reduction in the cash ISA allowance is likely and although it will be pitches as a measure to increase investment the main motivation will be increasing Government revenue.

What next?

With the Spring Statement wrapped up all eyes will turn to the Spending Review announcement in June. This is likely to include wider policy measures including the Government’s Housing Strategy and details of the new mortgage guarantee scheme.

The Chancellor will be hoping measures to boost economic growth start to work and global factors don't have too much of an impact. Without progress the Autumn Budget may be even more uncomfortable.