The Great Divide: First-Time Buyers, Inherited Wealth and the UK Housing Crisis

Why your parents might be more important than your job when it comes to buying a house in the future

The dream of homeownership in the UK is increasingly feeling like a lottery, where the winning ticket is less about hard work and more about familial wealth. Research from the Building Societies Association shows that it is increasingly necessary to have dual high incomes or family support to become a first time buyer.

Research suggests that a fifth (21%) of UK 18-to-34-year-olds and three fifths (59%) of those aged 35 to 54 are unsure if they will ever own a home or are not planning to do so at all. Many have simply given up on what in previous generation was an achievable milestone.

For first-time buyers, the hurdles are higher than ever, and the impending "great wealth transfer" from the baby boomer generation is poised to exacerbate existing inequalities. The pass through of money from older generations is already having an impact through the much spoken about Bank of Mum and Dad. In 2023/24, around 40% of first-time buyers had some assistance raising a deposit, either in the form of a gift or loan from family or friends, or through an inheritance.

People from the most advantaged parental backgrounds (high educated homeowner parents) are three times more likely to report housing wealth (i.e. owning a home) by age 35 and the average level of housing wealth is roughly ten times higher (£10,535 versus £105,295 measured in 2022 prices) compared to individuals from the most disadvantaged background (low educated renter parents).

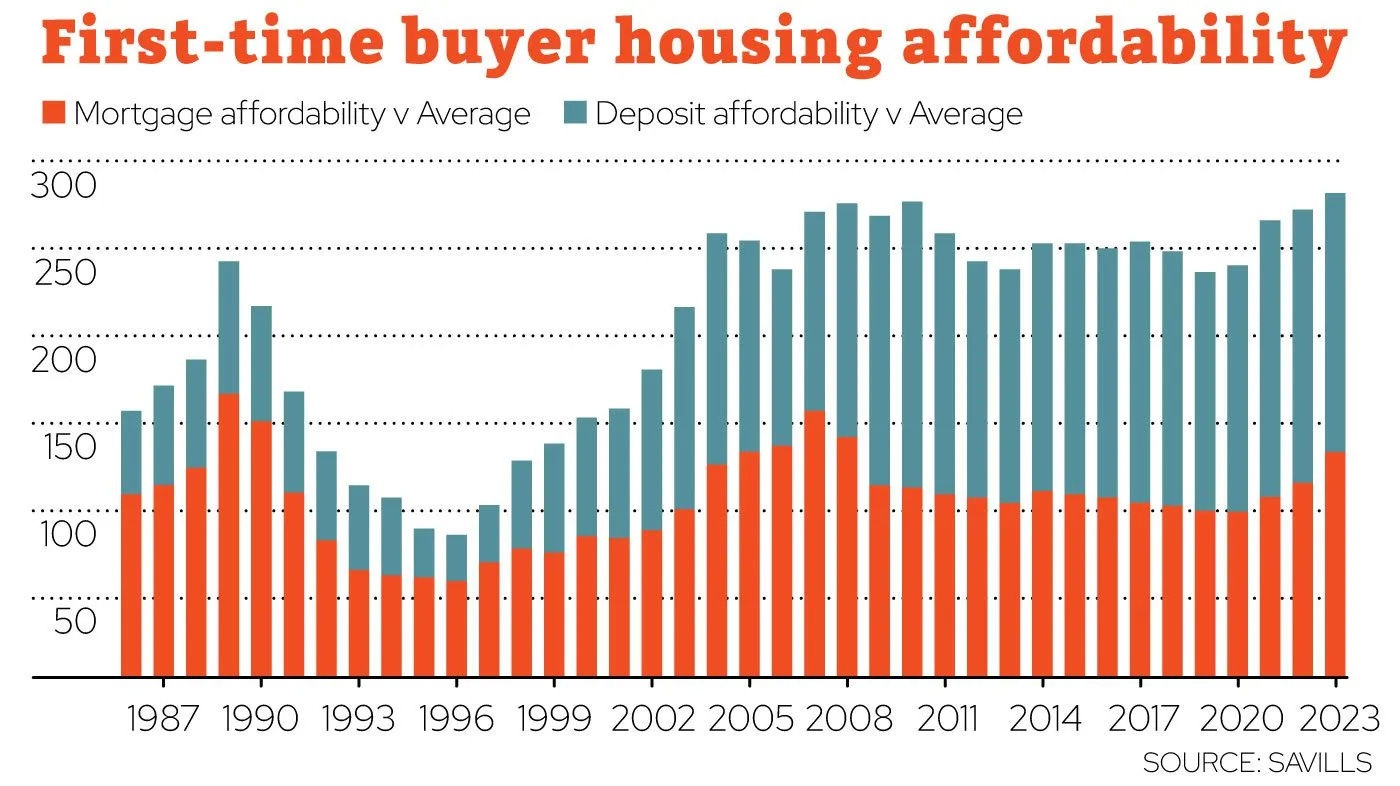

The challenge facing first time buyers is set out in the chart below:

The Deposit Dilemma

To put it bluntly, for most people saving for a deposit is brutal. With soaring house prices and stagnant wage growth, building up a substantial deposit feels like an impossible feat. The average deposit for a successful first-time buyer in the UK is now around £60,000 up around 160% since 2005. This varies across the country from around £27,000 in the North East to £144,000 in London. BSA-First-Time-Buyers-Report-2024-(Interactive-Single-Page)-(1)_1.pdf

What are the barriers to building a deposit? To start with, rents are eating up a large chunk of young people's income, leaving little room for saving. Average rent in England was £1,375 in January 2025 and increase of £112 (8.8%) from a year earlier. Again the situation in London stands out from the rest of the UK with average rents of £2,227, an 11% increase over the course of 2025. This creates a vicious cycle where renting prevents saving, and lack of savings prevents buying.

At this point we start to see another form of wealth, and also in this case geographic, inequality creep in. The children of parents with larger homes in and around London are more able to access the high quality jobs and economic opportunities provided by the city without having to rent privately.

Research from the Resolution Foundation shows that the proportion of younger adults (under-35) living with their parents has risen from one-in-four (26 per cent) in 2000 to nearly two-in-five (39 per cent) in 2021-2022, equivalent to an extra 2 million people. Increasingly living with parents for longer isn’t seen as a last resort but a positive option and an investment for the future.

It could mean that younger people are more likely to be able to take on career boosting internships or low paying jobs which enable them to access other areas such as creative industries. Lack of access to good quality affordable homes may mean in future we see a lot more Benedict Cumberbatches and far fewer Danny Dyers.

Add high levels of inflation into this mix and the ability to raise a deposit becomes that little bit more difficult. The cost of living crisis has eroded savings potential as effectively every pound spent on essentials is a pound less that can go towards a deposit. And it if you do manage save and buy a home it’s likely to be making your mortgage payments higher.

Mortgage Payment Mayhem

Even if a deposit is somehow scraped together, the challenge doesn't end there. With increases in interest rates mortgage affordability is another minefield buyers now need to deal with. The heady days of the 2010s and mortgage rates around 1% are long gone and probably unlikely to return.

The increases in interest rates have pushed many first-time buyers beyond their financial limits. Monthly mortgage payments for first time buyers have increased from £590 in 2020 to £940 now - an increase of £350. If those monthly payments are too high then they either won’t able to get a mortgage in the first place or will struggle once they own a home.

Higher monthly payments could also lead to struggles with affordability tests. Mortgage lenders apply stringent stress tests, assessing whether borrowers can afford repayments if interest rates rise further. This can disqualify many aspiring homeowners and could potentially be more of a problem with higher interest rates.

The Boomer Inheritance and the Growing Divide

Here's where the "great wealth transfer" comes into play. The baby boomer generation, who benefited from decades of rising property values and generous pension schemes, are now passing on their wealth to their children.

Around £2.18tn of owner-occupiers' equity in the UK is now held by the over-65s and over the next two decades a significant proportion of this will filter down to their children. The scale of this transfer is set out in the chart below:

This wealth is already starting to have an impact on the housing market through the Bank of Mum and Dad. For some, parental financial support will have been the only way to bridge the deposit gap. This starts to create a two-tiered system where those with wealthy parents have a significant advantage when it come to buying a home.

This will lead to what might be considered “Inheritance Inequality” As inheritances become more common, those without access to this wealth are likely to start being left behind, further widening the gap between the haves and have-nots. It may be the case in the future that the only way to achieve a mortgage deposit is through inheritance.

In turn this process is likely to distort the market. Injections of parental wealth into the housing market without appropriate increases in housing supply will fuel demand and drive up prices, making it even harder for those without such support to compete. Some family homes may also simply not come onto the market if they are passing directly from parents to children rather than being sold.

The Implications: Why we should care

This growing reliance on inherited wealth has profound implications for not just home ownership but also social mobility and equality.

The disparity it will cause is likely to lead to resentment and frustration among those excluded from home ownership. The perception the housing market is rigged against them and their hard work and qualifications are made inconsequential by inherited wealth, could create a deep-seated sense of injustice. This is would be particularly the case for those who have diligently pursued education and career development, only to find themselves unable to compete with those who possess the "unfair advantage" of family financial support.

This could in turn lead to a sense of disillusionment, a diminished belief in the importance of individual effort, and a growing cynicism towards society. This is not just an economic disadvantage but a fundamental challenge the understanding that hard work will be rewarded.

When a significant portion of the population is excluded from homeownership, it can stifle economic dynamism and innovation. The incentive to work hard, to take risks and to be entrepreneurial is diminished when one of the key rewards of these efforts, owning a home is seen as out of reach.

A housing market dominated by inherited wealth could also lead to more of that wealth being locked up in people's homes. Instead of being used for other types of investment or starting a business it will instead be used to buy increasingly expensive homes. This could result in a stagnant economy with limited economic growth.

The problem is essentially twofold: those with inherited wealth may feel less need to strive, while those without may feel their striving is futile. This creates a society where neither group is fully motivated.

Beyond the immediate economic impacts, the growing housing crisis is contributing to a wider societal problem as a result of a growing reluctance to have children.

The financial burden of raising a family, coupled with the need to do so in astable appropriately sized homes, is dissuading many young people from starting families or forcing them to have children later. This demographic shift has profound implications for the future of society, potentially leading to an aging population.

What Can Be Done?

Governments for many years have spoken about the need to build more homes and address housing affordability. The current Government's reform of the planning system is a good start. Genuine action on this complex issue requires multiple interventions from Government.

To address this, the UK government must adopt a comprehensive and multifaceted policy approach, moving beyond rhetoric to tangible solutions.

1. Unlocking Housing Supply: Building More Homes

The cornerstone of any effective housing strategy is increasing the supply of homes (something you'd absolutely expect Build More Homes! to say. We must move beyond simply increasing overall housing numbers and focus on delivering properties that meet the needs of those locked out of the market. This requires:

Strategic Land Release: Prioritising brownfield development and releasing public land for housing projects, while ensuring environmental considerations are met.

Further Planning Reform: Streamlining the planning process to speed up the delivery of new homes. This includes reducing green belt restrictions, ensuring only the right organisations are statutory consultees on planning applications and incentivising local authorities to approve affordable housing developments.

Supporting Innovative Construction Methods: They haven't taken off as yet but further steps to explore the possibility of approaches like off-site construction could boost the number of new homes.

2. Fostering Inclusive Economic Growth: Boosting Wages and Opportunity

While increasing housing supply is crucial, it must be coupled with policies that address the underlying economic factors driving housing unaffordability including a lack of economic growth and stagnant wages.

Investing in Skills and Training: Equipping young people with the skills needed to secure well-paying jobs, boosting their earning potential and ability to save for a deposit. If skills training can also be focused to some extent on construction skills it could help remove another barrier to building new homes

Promoting Regional Economic Development: Addressing regional disparities in economic opportunity by investing in infrastructure and supporting business growth in areas outside of London and the South East could help spread wealth across the country. Better quality jobs and other economic opportunities outside London and the South East could also remove housing pressure in these areas.

3. Empowering First-Time Buyers: Regulatory Freedom and Improved Government Support

The Government can play a crucial role in supporting first-time buyers through innovative support schemes both directly and by supporting changes by regulators.

Reverse Some Post 2008 Regulatory Restrictions: Increasing the Bank of England FPC’s flow limit, which caps mortgage lending at more than 4.5 times income to 15% of a lender’s business, would help enable more people to buy a home. Changing FCA rules to allow more first time buyer access to part interest only part repayment lending would also help ensure those earning enough could get a mortgage.

Support With Saving For A Deposit: Reintroducing the "Help to Save" scheme, and providing generous government bonuses to encourage saving for a deposit would help with the difficulties of building a deposit. Raising or removing the house price cap on Help to Buy ISAs and Lifetime ISAs should be an immediate priority. The HTB ISA price cap of £250,000 outside London (£450,000 in London has been the same since 2015 and the £450,000 LISA cap hasn’t changed since 2017. Updated these in line with house price inflation should be an absolute minimum.

A Well Designed Mortgage Guarantee Scheme: Ensuring the Government’s proposed mortgage guarantee scheme is effectively targeted to support first time buyers is essential. Allowing flexibility for mortgage lenders in its use and a focused on supporting higher loan to value lending on new build properties would be positive steps

While a sensitive topic, a discussion about inheritance tax reform would be a bold reform for any Government to have on its agenda. Political sensitivities around this complex and emotional issue means this is an unlikely area for action.

Without decisive action, the dream of homeownership will become increasingly out of reach for a generation, and the great wealth transfer will only exacerbate existing inequalities. Politicians and the housing sector need to be thinking about these issues now to create a fairer and more equitable housing market for all in the future.